"*" indicates required fields

Find the Best Business Loan in Minutes – No Impact on Credit Score

Compare top lenders and secure the best deal for your business – fast, easy, and obligation-free.

Why Thousands of Business Owners Trust Us.

Fast, Flexible, and Trusted Business Financing – See Why We’re the Go-To Choice

Fast Approvals

Get funding in as little as 24 hours.

No Impact on Credit Score

Compare offers risk-free.

Personalised Offers

Find the best rates tailored to you.

Expert Support

Find the best rates tailored to you.

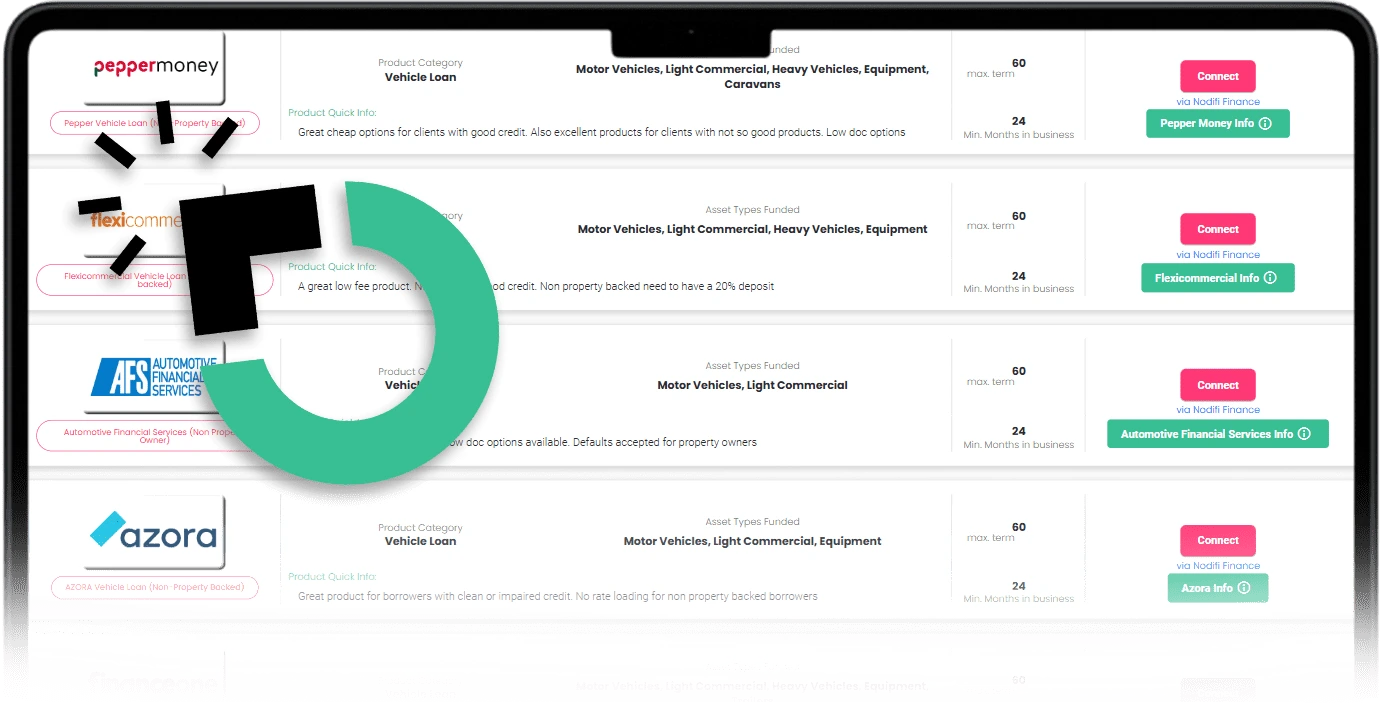

Dominate Your Options with Access to 40+ Lenders — Powering Businesses Across Australia!

Fast, Hassle-Free Loan Matching in 3 Easy Steps.

Just 3 Simple Steps to Instant Finance — No Impact on Your Credit Score!

1. Tell Us About Your Business

Answer a few quick questions – it takes less than 2 minutes.

2. Compare Your Options

3. Get Funded Fast

We Empower Australian Small Businesses

Whether you’re looking to finance a new vehicle for you business or need working capital to help your business grow we have the right product for you. We know how hard it is for business owners to get money from the banks. They often want a house as security before they will lend you the money.

We here at ClickCapital don’t think that’s fair. That’s why we have brought together a unique blend of lenders to offer you vehicles, property, working capital, assets and yellow good finance products all without offering up your home as security.

Australian Dollars Funded

Businesses Funded

Finance Products

Repayment Calculator

Adjust the loan amount, interest rate, and repayment period to determine the monthly payment. You can also modify the monthly payment to estimate the potential loan amount.

Disclaimer: This calculator provides estimates for informational purposes only. Speak to our licensed Finance Brokers to assess suitability. Terms, conditions, fees, and minimum loan amounts apply. Credit approval and interest rates depend on your credit profile and the asset being financed.

Your Results

Monthly Payment: $0.00

Total Payment: $0.00

Total Interest: $0.00

Love at first loan? Our customers think so!

“The team at Clickcapital were amazing. I needed funds to fit out a new surgery. I applied online and within 2 days I had the money in my account”

“I have just taken on two new apprentices and we needed a capital injection to keep us going in between getting paid for jobs. Clickcapital’s Unsecured Business Loan was perfect for us. It kept us going in between being paid”

Book a Call.

Talk to a real person. Get real answers.

Ready to move your business forward?

Whether you’re exploring funding options, have questions about eligibility, or just want to chat through your goals — we’re here to help.

Book a free, no-obligation call with one of our lending specialists today. We’ll take the time to understand your business and recommend the right solutions, tailored to your needs.

Got questions? We’ve got answers!

What types of loans does ClickCapital offer?

ClickCapital offers Small Business Loans, Business Line of Credit, Equipment Finance, and Vehicle Finance to help businesses grow and thrive.

How does the loan application process work?

Applying with ClickCapital is simple! Fill out our quick online application, upload your documents, and get approved within 24 hours. Fast, easy, and hassle-free!

What documents are required for my application?

To apply with ClickCapital, you’ll need:

✅ 6 months of bank statements

✅ Your ABN/ACN

✅ Valid identification

That’s it—simple and straightforward!

What is the minimum loan amount?

Can I repay my loan early without penalties?

What is a Business Line of Credit?

A Business Line of Credit gives you flexible access to funds whenever you need them. You only pay interest on what you use, making it a smart solution for managing cash flow and unexpected expenses.

What industries does ClickCapital support?

ClickCapital provides funding for a wide range of industries, including retail, construction, healthcare, professional services, and more. If your business needs financing, we’re here to help!

How long are the repayment terms?

ClickCapital offers flexible repayment terms ranging from 3 to 60 months for most loans, and up to 25 years for Commercial Property Finance. We tailor financing to suit your business needs!

What happens if I miss a repayment?

If you miss a repayment, please contact ClickCapital as soon as possible. We’re here to help you explore options and minimize any additional fees.

How do I apply for a ClickCapital loan?

Applying is quick and easy! Simply fill out our short online application form on the ClickCapital website, and we’ll guide you through the next steps.