Any small business will run with proper business planning, proper funding, and with good working capital. This is the most common answer when it comes to the question: “What keeps a business continuously running everyday?” While this is a proper and correct answer, if you want to pick one out of the three, the most important one would be a good working capital. Why?

A working capital is used in the daily operations of the business. It is used to fund both long and short-term operations, and the business’ ongoing obligations. A small business that has enough working capital will be able to pay their suppliers, their employees, and have money to go through the business’ daily expenses and needs.

Getting a Business’ Working Capital

A business’ working capital is actually the difference between the current assets of the business and the business’ current liabilities & debts. A working capital is essential to any small business as it literally gives the small business life and limbs, making it able to stand and fully function on a daily basis.

Working Capital: An essential for small businesses

A business has daily necessities and obligations that it needs to cover, from overhead expenses, to routine payments, to unexpected purchases, and to the purchase of materials for the production of goods or for restocking of products. This is what a small business’ working capital covers.

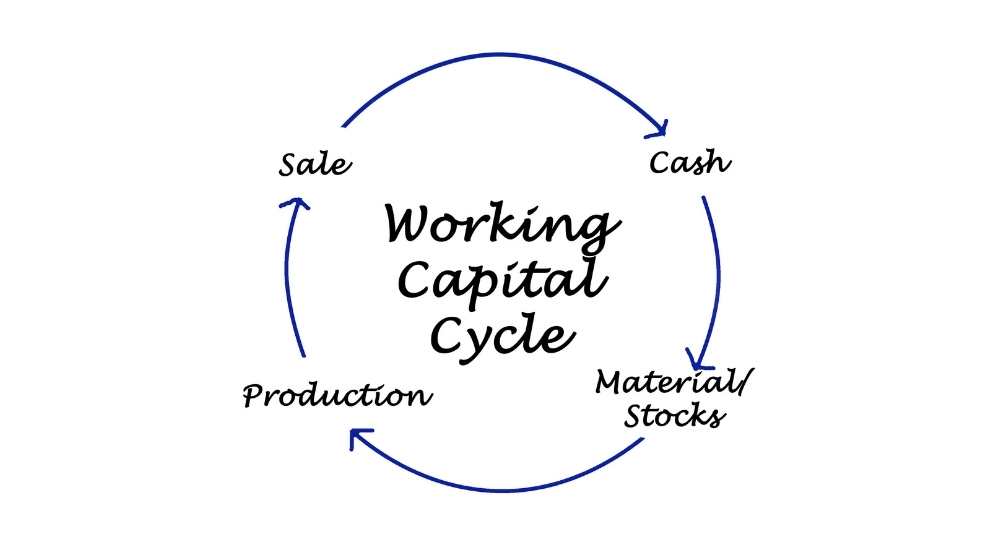

What a small business owner needs is an efficient management of the business’ working capital. This can include managing the business account receivables and inventory management of the business. The main thing a small business owner needs to focus on is to maintain the working capital of the business along with its operating cycle, ensuring that the operation goes smoothly, minimizing the capital spent, and maximizing the return of investments of the assets of the business.

We can all think of a working capital as an individual’s cost of everyday living, this way the concept of a working capital is more personal. An individual person is expected to earn and collect money in order to live a normal life on a daily basis. They are expected to cover their bills, day-to-day personal expenses, and other expenditures that may come their way.

Essentially, a working capital measures the health of the business and its projected longevity. Additionally, a good working capital can mean that the business is efficient in its daily operations.

Every industry’s working capital needs differ from one to another, and believe it or not, can also vary within industries or businesses that are similar to each other. The factors that can affect this ranges as well from the amount of rent going into the business space, the time the purchases of the assets occur, a business’ accounts receivables, and the capital making efforts that the business is currently involved in.

How Working Capital affects the business Cash Flow

Cash flow is basically the amount of money the business earns in a certain period of time, usually calculated in an accounting period. If the revenue of the business declines, the cash flow of the business will decline as well, and the amount of the business’ working capital might not be able to sustain that of the business’ everyday operations. On the other hand, if the cash flow is positive, then that means the business’ working capital will be able to account for every expense the business has during that period of time.

Managing a small business means that one must always be in mind of the working capital that it has, as it is the bloodline that will keep the business running with its complete limbs.